Life Insurance

- Understand the level of cover that may be appropriate for your family’s needs

- Explore premium options based on your budget and circumstances

- Help cover financial commitments, such as a mortgage or other debts

- Provide a way to offer financial support to your loved ones

Download our FREE first time buyer’s guide

We’ll send you important industry news and information to keep you in the loop with what’s happening in the mortgage industry.

Why Does Life Insurance Matter?

Life insurance can help provide financial support for your family if you were to die during the policy term. It is designed to help support those who depend on you, by contributing towards ongoing costs and financial commitments, depending on the level of cover chosen.

Life insurance may be used to:

- Help support housing costs, such as a mortgage or rent

- Contribute towards replacing lost income, depending on the level of cover

- Help manage outstanding financial commitments, such as loans or debts

- Support longer-term financial planning, including future expenses

- Offer financial support for your loved ones, in line with the policy’s cover

Life insurance types

The two main types of life insurance are level term and decreasing term life insurance.

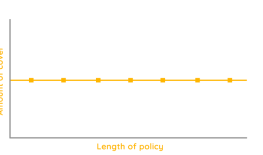

Level Term

The amount insured remains the same throughout the policy term, so the level of cover does not change during that period.

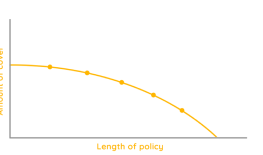

Decreasing Term

The amount insured reduces over the term of the policy. This type of cover is commonly used alongside debts such as a repayment mortgage.

Life Insurance Options

The suitability of each type depends on your individual circumstances and financial goals.

Level Term Life Insurance

Pays a fixed amount if you die during the policy term. This type of cover is often used to help support financial commitments such as a mortgage or to provide income protection, depending on the level of cover chosen.

Decreasing Term Life Insurance

Designed to help cover debts that reduce over time, such as a repayment mortgage. The amount of cover decreases during the policy term, in line with the policy structure.

Family Income Benefit

Rather than a lump sum, this type of policy can provide a regular income if you die during the policy term, which may help contribute towards ongoing living costs.

Life Insurance Scenarios?

Life insurance can help provide financial support for people who depend on you. While everyone’s circumstances are different, there are certain life situations where having cover in place may be worth considering. Life insurance needs vary by personal circumstances.

Couple / Married

If you share financial responsibilities with a partner, life insurance may help contribute towards ongoing household costs if one income were lost.

Children / Dependents

If others rely on your income — such as children or other dependants — life insurance may contribute towards everyday living costs.

Property Owner / Debts

If you have a mortgage or other borrowing, life insurance may help contribute towards these commitments.

Sole Earner

If you are the main income earner in your household, life insurance may help support ongoing household expenses.

Explore buy to let products

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Buy to let remortgages

Remortgage your existing buy to let a better deal.

Life Insurance FAQ’s

What is life insurance and how does it work?

Life insurance is a policy that can pay out a cash lump sum if you die during the policy term. This money may be used to help support your family, contribute towards debts such as a mortgage, or assist with day-to-day living costs, depending on the policy.

How much life insurance cover do I need?

The amount of cover you may need will depend on your financial situation, including your mortgage balance, debts, income, number of dependants, and future expenses such as childcare or education. A specialist adviser can help you assess what level of cover may be appropriate for your circumstances.

How long should my life insurance policy last?

Most people match the policy length to major financial commitments, such as the remaining term on their mortgage or the number of years until their children become financially independent.

Do I need life insurance if I’m single?

You may still wish to consider life insurance if you have debts that could pass to someone else, want to leave a financial gift, or want to help contribute towards funeral costs.

Is life insurance necessary if I already have cover through work?

Workplace life cover (often called “death in service”) can be useful, but it may not be sufficient on its own. Cover is often limited and may end if you change jobs, so some people also consider taking out additional personal cover.

Will life insurance pay out for any cause of death?

Many life insurance policies cover most causes of death, subject to exclusions such as suicide within the first 12 months or non-disclosure of relevant medical information. The exact cover and exclusions will depend on the insurer and policy terms.

How much does life insurance cost?

Premiums depend on factors such as your age, health, lifestyle (including smoking), and the amount of cover you choose. The cost will vary between individuals and insurers.

Can I get life insurance if I have a pre-existing medical condition?

Some insurers may still consider applications from people with medical conditions, although premiums and terms can vary depending on the condition and medical history. A broker can help explain which insurers may be suitable.

What’s the difference between level term and decreasing life insurance?

Level term insurance provides a fixed level of cover that remains the same throughout the policy term.

Decreasing term reduces over time and is commonly used alongside a repayment mortgage.

Will my life insurance payout be taxed?

Life insurance payouts are generally not subject to income tax or capital gains tax. However, they may form part of your estate for inheritance tax purposes unless the policy is written in trust. Tax treatment can vary and may change in the future.